Nomi Smith draws from personal experience to build diverse team at her company, PMI Rate Pro

For years the mortgage industry has been dominated by white males in their mid-forties, but that didn’t stop PMI Rate Pro Founder and CEO, Nomi Smith, from starting her career as a loan officer. Smith, a female immigrant from Mongolia, moved to the United States to pursue her MBA in 2007, and is 35 years old (10 years younger than the median loan officer’s age).

“One thing I can tell you is there is not enough diversity in the mortgage industry, there is a very small number of loan officers that are people of color, and being an Asian female is even more rare” said Smith.

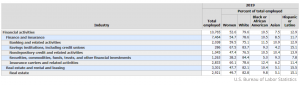

According to the U.S. Bureau of Labor Statistics, only 20% of professionals working in financial activities identify as non-white, with Asian females making up one of the smallest percentages in the market. In real estate, the percentage of women occupying the space drops under half, and the percentage of Black and Asian Americans employed are some of the lowest in the entire sector.

Although female loan officers may be harder to come by, Smith says being a woman in the mortgage industry is an advantage when working with borrowers.

“Meeting with a loan officer can be an intimidating process for first time homebuyers,” said Smith. “They might not be as intimidated to talk to a female loan officer, since we can relate to the feeling of being new to the industry. [Because of this] I’m able to bring a better sense of understanding to my meetings and create a relaxed atmosphere to make people feel comfortable.”

Barriers for People of Color

According to Smith, a potential barrier to starting a career in the mortgage industry is the nature of the work itself. Loan officers start their business working on full commission, and it takes time to build up a consistent customer base.

“I was lucky enough that when I joined the industry someone took me on as a junior loan officer and helped me through that process,” Smith said. “If I didn’t have that opportunity, or I didn’t know that person, it would have been very difficult for me to get started.”

There aren’t enough people of color being attracted to the mortgage industry; maybe because they don’t know how to get started, can’t afford to take the financial risk, or don’t know the right people to get into a company.

The solution? More education and mentorship in the areas that need it most.

“Whether it’s buying a home or entering the mortgage industry as a profession, it all comes back to education,” said Smith. “Mortgage companies must go out and actively recruit at colleges and high schools in areas that have more diverse populations. That would empower young, different races of people, both women and men, to want to take the risk to enter the industry.”

Moves to Improve Diversity

Organizations across the board have made commitments to increase the diversity of the industry:

* The National Association of Minority Mortgage Bankers of America (NAMMBA) is a national trade association dedicated to the enrichment and betterment of minorities and women who work in the mortgage industry.

* The Mortgage Bankers Association (MBA) offers a program called mPower, MBA Promoting Opportunities for Women to Extend their Reach, a networking platform for women in real estate finance.

* MBA also hosts the Path to Diversity Scholarship Program annually, which recognizes existing industry professionals seeking to continue their education, enabling employees from diverse backgrounds to advance their professional growth.

* NEXT Mortgage hosts their women’s executive mortgage summits twice a year. The program launched in 2018, and is the first mortgage industry event specifically for high ranking women executives. PMI Rate Pro VP of Operations Megan Darnell was a speaker at NEXT in Feb. of 2019 and featured in their #NEXTraordinary People blog last April.

* Read More: Lender Initiatives to Recruit and Retain a More Diverse Workforce

PMI Rate Pro Founded on Inclusion

Not only does PMI Rate Pro open the housing market to thousands of buyers with lesser income, their company culture was crafted with diversity in mind. Because of her personal experiences, Smith leads with an inclusive mindset that draws a talented and diverse team.

Co-Founders Luke Landau, Nomi Smith, and CIO Donald Hawkins.

Joining her in leading the company is Co-Founder Luke Landau, and CIO Donald Hawkins. In addition to the diversity of their C-suite execs, PMI Rate Pro employees are nearly all women (80%) with every team member coming from a different and unique background.

“We all work really well together because we can all come to the table with different perspectives,” said Smith. I think the best teams are the ones that can bring so many different perspectives together, from a woman’s point of view to the point of view of different races, and collaborate to create something really beautiful.”

About PMI Rate Pro

PMI Rate Pro transforms the private mortgage insurance quoting process with innovative software that provides rates from every mortgage insurer in seconds, saving time and money. By providing accurate quotes for homebuyers in seconds, loan officers are able to win more deals while saving borrowers money on their insurance rates. The company was founded by Nomi Smith and Luke Landau, two tenured mortgage officers who recognized that homebuyers have been overpaying for private mortgage insurance for decades. For more information on PMI Rate Pro, visit www.pmiratepro.com.